In 2013, Alice Eminza Mubusi was facing financial ruin. Barely making more than her average daily financial requirements and having lost her son to an unexpected family crisis, Alice and her family were forced to live hand-to-mouth with her meager farming income. However, armed with a burning desire to make life better for her family, she began her journey to becoming a good steward of her money.

It all started with saving advice from the Nuru Kenya Financial Inclusion (FI) Field Officer, Jackson Mohochi.

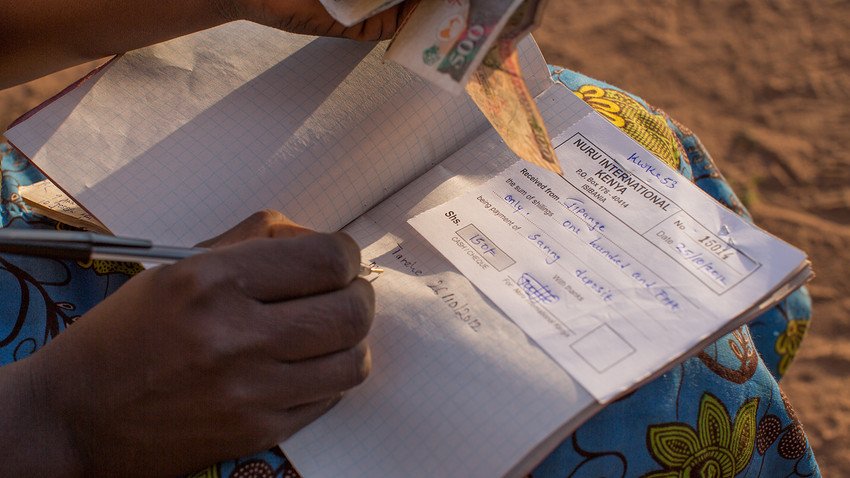

With help from Jackson, Alice set a goal: to save 100 shillings (~$1) a week towards a group savings account with the plan that she could access this savings in case of unexpected family emergency.

The Field Officer’s financial literacy trainings helped Alice to commit to a portion of her income to start saving regularly. She sealed the deal by enrolling in the group savings program of Nuru Kenya. “Having a group savings account helped me to understand the value of planning my financial resources effectively,” said Alice. When she first signed up as an FI program saver, she pledged to save money toward putting up a better, modern house—a permanent structure with an actual roof, rather than a home made of only mud, sticks and grasses.

She and her Nguku Kifaru savings group members consistently participated in the savings program throughout 2014. By the end of December 2014, she and her group members had saved a net amount of 12,630 shillings (over $145)—a huge accomplishment! This provided a safety net for each saver, as well as the possibility of distributing a group loan that any one saver could use for emergencies, home improvements, purchasing livestock or starting a business—and more. Beyond the monetary reward, Alice says putting aside money has given her confidence and a sense of security and freedom. “It’s empowerment,” she said.